Legal Status - SEPTEMBER 2021

Media: Are users of online platforms solely responsible for the content they upload?

ENERGY

The Ministry for Ecological Transition announces a new 3.300 MW wind and photovoltaic auction in October

IGNACIO PUIG

Senior Associate

The Resolution of September 8, 2021, of the Secretary of State for Energy has been published in the Official State Gazette (BOE), announcing the second auction for the granting of the renewable energy economic regime (REER) under the provisions of Order TED/1161/2020, of December 4, 2021.

The objective of the auction is threefold: to accelerate the decarbonization of the electricity sector, reduce the price of electricity and boost the economy.

The auction is aimed at electricity generation facilities from renewable energy sources composed of one or more of the technologies corresponding to subgroups b.1.1 (solar energy) and b.2.1 (wind energy) defined in article 2.1 of Royal Decree 413/2014, of June 6, and provides for a product quota to be auctioned of 3,300 MW.

Four minimum reserves to be allocated to different technologies or categories distinguishable by their specific characteristics are established, in compliance with the cumulative indicative calendar approved by Order TED/1161/2020 of 4 December:

• a first reserve of 600 MW for photovoltaic and wind installations with accelerated availability.

• a second reserve of 300 MW for local distributed generation photovoltaic installations (with a capacity of 5 MW or less).

• a third reserve of 700 MW for general PV installations (subgroup b.1.1).

• a final reserve of 1,500 MW for onshore wind technology (subgroup b.2.1).

This resolution also approves the remaining aspects established in article 6 of Order TED/1161/2020, of 4 December, which include the auction calendar, its detailed specifications, and forms for participation as well as the other parameters necessary to carry out the auction and to apply the economic regime for renewable energies.

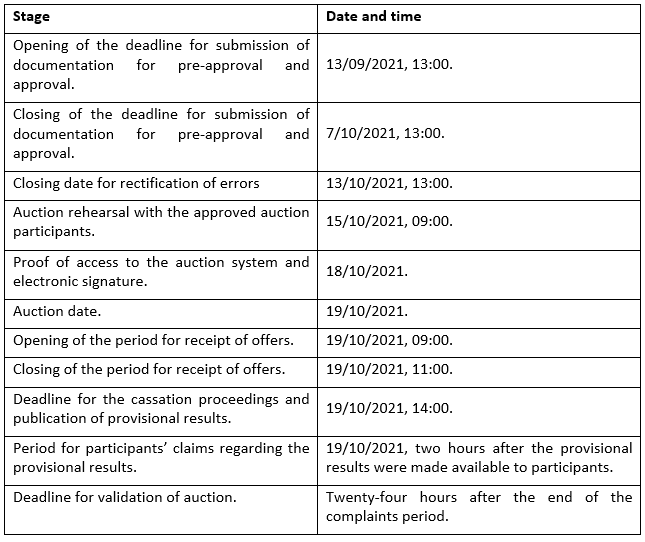

The proposed timetable for the auction is as follows:

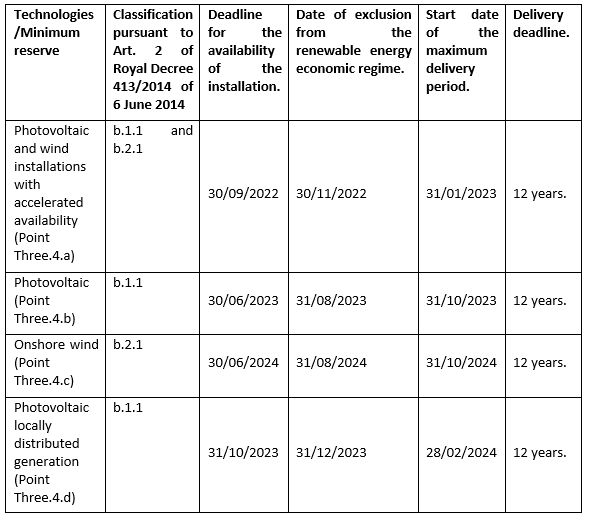

Furthermore, it establishes the deadline for the availability of the installation, the date of exclusion from the renewable energy economic regime, the start date of the maximum delivery period and the maximum delivery period, as defined in articles 16 and 28 of Royal Decree 960/2020, of 3 November, which are set out in the following table.

It is remarkable that the deadlines within which the successful bidders must have the facilities available are shorter than those of the first auction.

The projects corresponding to the accelerated availability reserve must be available no later than September 30, 2022, which represents a period of less than one year from the scheduled auction date, October 19, 2021.

In addition, the Resolution anticipates that another auction will be held this year with a minimum of 200 MW of solar thermoelectric, 140 MW of biomass and 20 MW of other technologies.

September 2021

EMPLOYMENT

Is the Equality Plan mandatory? Quantification of the number of employees and possible penalties

BEATRIZ CORRAL

Associate

On January 12, 2020, the “Royal Decree 901/2020, of October 13, 2020, regulating equality plans and their registration and amending Royal Decree 713/2010, of May 28, on registration and deposit of collective bargaining agreements and collective bargaining agreements” was published in the BOE, with the aim of covering the different issues regarding equality plans, diagnosis, registration obligations, deposit, and access.

Gradual obligation

RD 901/2020 establishes that Equality Plans are mandatory for all companies with more than 50 employees. However, this mandatory requirement will be introduced progressively until 2022:

• As of March 7, 2020, it was mandatory for companies with more than 150 employees

• From March 7, 2021, it was mandatory for companies with more than 100 employees

• From March 7, 2022, it will be mandatory for companies with more than 50 employees.

Quantification of the number of employees of a company

In terms of the calculation of the number of employees that give rise to the obligation to draw up an Equality Plan, Article 3 of RD 901/2020 establishes that the entire workforce must be taken into account, regardless of the number of workplaces the company has and the type of employment contract of the employees.

In this regard, companies will have a period of three months from the time they reach the number of employees on the payroll that make it mandatory to initiate the proceedings for the negotiation of the Equality Plan, without limiting the foregoing to those companies that regardless of number of employees are obliged by Collective Bargaining Agreement. In this case the term shall be established by the agreement itself or, failing that, three months from its publication.

Potential penalties for failure to draw up the Equality Plan

Failure to comply with the equality obligations established in the regulations may result in financial penalties with fines ranging from 626 euros to 189,515 euros, automatic loss of aid, bonuses and benefits derived from the application of employment programs, as well as the possibility of being excluded from access to such benefits for a period of six months to two years, with effect from the date of the resolution imposing the sanction.

The introduction of an Equality Plan, whether legally required or voluntary, will always bring benefits to a company, will increase its competitiveness and image, and will help to improve the labour environment by identifying situations of discrimination and avoiding labour conflicts.

September 2021

MEDIA

Are users of online platforms solely responsible for the content they upload?

FLORENCIA ARRÉBOLA

Senior Associate

On June 22, the Court of Justice of the European Union (“CJEU”) ruled on the questions referred for a preliminary ruling in joined cases C-682/18 and C-683/18 (“YouTube” and “Cyando”). These questions concern two cases in which users of content-sharing platforms YouTube and Uploaded made content available to the public without authorization, thus infringing copyright.

The relevant question is whether or not the operators of the platforms are liable for communicating to the public content not authorized by its author and, consequently, infringing copyright. It is worth noting that the questions referred for a preliminary ruling predate Directive 2019/790 on “Copyright” (“Copyright Directive”), so the CJEU does not apply that rule in the analysis. Therefore, the CJEU does not take into account that Article 17 of the Copyright Directive modifies the liability regime of large platforms such as YouTube for unlawful communication to the public made by their users.

In the “YouTube" case, Frank Peterson, a music producer, sued both YouTube LLC and Google LLC before the German courts for the uploading to YouTube of several phonograms on which he claimed to be the owner of a series of rights.

In the “Cyando” case, Elsevier Inc, a publishing group, filed a lawsuit against Cyando AG for posting online works to which Elsevier Inc. held exclusive rights on the Uploaded platform operated by Cyando AG.

In both cases, the content was uploaded by users of the platforms in question, without the authorization of the right holders, thus infringing Article 3 of Directive 2001/29/EC of the European Parliament and of the Council of 22 May 2001 on the harmonisation of certain aspects of copyright and related rights in the information society (“Copyright Directive”).

When does a platform communicate works to the public?

Article 3 of the Copyright Directive grants authors the “exclusive right to authorise or prohibit any communication to the public of their works, by wire or wireless means, including the making available to the public of their works in such a way that members of the public may access them from a place and at a time individually chosen by them”. Consequently, any user who communicates works to the public without authorization infringes authors’ rights, as was the case of YouTube and Uploaded users.

However, the CJEU had to clarify whether, in the particular context, the platforms themselves carried out an unlawful act of communication to the public and thus infringed authors’ rights.

In order to ascertain this, the CJEU lists a non-exhaustive list of additional factors, in line with previous case law. Specifically, it is a question of assessing whether the platform operator:

- Acts deliberately, in full knowledge of the consequences, with the aim of giving the public access to copyrighted content.

- Does not implement the appropriate technological measures expected of a diligent operator to “counter credibly and effectively copyright infringements”, despite the fact that the operator knows or should know that users are using the platform to make illegal content available to the public.

- Participates in selecting content made available to the public illegally.

- Provides tools to users for the purpose of sharing content illegally.

- Promotes illegal content sharing. As evidence, business models that encourage their users to share content to the public through the platform have been taken into account.

- The main use of the platform consists of making content available to the public in an unauthorized manner.

Do YouTube and Cyando communicate content to the public?

The CJEU considers that YouTube and Cyando do not carry out acts of communication to the public within the meaning of Article 3 of the Copyright Directive. The CJEU notes that uploads of content to YouTube and Uploaded occur automatically, i.e. the operators of the platforms do not create or select the uploaded content and do not view or monitor it before making it available to the public. Therefore, they do not deliberately make available to the public content infringing copyright and with actual knowledge that such making available is unlawful. In fact, both platforms inform users that uploading content without the owner’s authorization is prohibited, both before and after the content is made available online.

In the YouTube case, the CJEU states that YouTube has taken credible and effective measures to avoid infringing copyright. Furthermore, YouTube uses a series of systems to prevent copyright infringement and block content once the owner notifies it. In particular, it has implemented notification processes and alerts for illegal content, as well as content verification programs. While it is true that YouTube makes lists of content, separates uploaded content by category and presents users with a synopsis of recommended videos based on each user’s history, the CJEU considers that such actions are not intended to facilitate the unlawful exchange of protected content or to promote such exchange. Finally, according to the CJEU, YouTube does not base its economic model on unlawfully uploaded content, nor does it encourage users to do so. Therefore, its objective is not the unauthorized sharing of copyrighted content.

The Uploaded platform, on the other hand, does not allow uploaded content to be exchanged with other users. The Uploaded user who uploads a file receives a download link and cannot publish this link anywhere on the platform. The platform does not even have a search engine, so users do not know what content is hosted on the platform and cannot access it. Therefore, the CJEU considers that the platform does not facilitate the unlawful exchange of protected content. In fact, the download links are shared on other websites, completely unrelated to Cyando. That said, the CJEU does not make an assessment of the disputed facts between the parties, which are basically what proportion of files hosted on Uploaded infringe copyright and whether the business model adopted by Uploaded is based on the availability of illegal content. This is a matter for the referring court.

Conclusion

To sum up, the CJEU has ruled that the operators of YouTube and Uploaded are not liable for the copyright infringements carried out by their users. However, it does not rule out that the operators may be held liable for the content made available to the public through their platforms.

In order for the exemption from liability to apply, the key are the measures adopted to combat online copyright infringement, especially when the platform operator is notified of such infringement, also relevant to the courts is whether the economic model adopted is based on the availability of lawful content and whether the platform operator participates in the selection of content communicated to the public or promotes the lawful exchange of content.

Furthermore, the CJEU shall in due course clarify and define the scope of liability of online content platforms in these cases, in light of the new Article 17 of the Copyright Directive.

September 2021

CORPORATE

Implementation of the Startups Law

DANAE BALCELLS

Associate

Last July 27 was the end of the public consultation period on the Draft Law to promote startups (hereinafter, the “Draft Law”). The Draft Law is part of a legislative move aimed at promoting the creation and growth of startups, particularly technology-based companies to foster innovation throughout the country in order to make Spain a centre of attraction for talent, capital and entrepreneurs.

This regulation justifies a special and separate regime for startups for two reasons. First, they require measures to facilitate the attraction of capital and talent due to the great international competition to which they are subject. Second, the success of startups depends to a large extent on their ability to attract investment in order to test their concepts and develop their innovative projects.

Thus, the most relevant innovations in the Draft Law are measures that reduce the tax and labour burden, as well as administrative procedures for the creation and closure of startup companies.

Definition of an emerging company or startup

The Draft Law defines an emerging company as newly created individual or legal entities that are established in Spain and are innovative in nature, that is, their purpose is “to solve a problem or improve an existing situation through the development of products, services or processes that are new or substantially improved in comparison with the state of the art and that involve a risk of technological or industrial failure”, which must be accredited by the administration on a yearly basis. Furthermore, startup companies must not exceed five million euros in annual turnover, they must not be listed as public companies nor distribute dividends.

Tax measures

The Draft Law introduces a series of tax measures aimed at encouraging the creation and growth of emerging companies. Among the most important of these measures is a reduction of the corporate income tax rate to 15% for four years. Moreover, the minimum annual exemption for rights or options on shares or stock options for employees is increased to €45,000 (currently €12,000). Likewise, in terms of personal income tax, the deduction rate for investments in new or recently created companies is increased to 40%, establishing the maximum deduction base at €100,000 per year. The Draft Law also gives an option for workers transferred to Spain to be taxed as non-residents, easing the requirements and giving the possibility to their families to opt for this special regime.

Measures to attract foreign investment

The measures to attract foreign investment include the elimination of the requirement for investors who do not wish to reside in Spain to obtain a foreigner's identity number. If the Draft Law is approved as currently drafted, these investors shall only be required to obtain a tax identification number (NIF), which they will be able to obtain online. Foreign legal entities shall also be able to obtain the NIF easily through the Centro de Información y Red de Creación de Empresa (CIRCE) [Information Centre and Company Creation Network].

Recruitment of foreign talent

In order to promote the attraction of foreign talent to Spain, the Draft Law allows emerging limited liability companies to acquire their own shares, up to 20% of the capital stock, provided that this is done with the purpose of executing a remuneration plan.

Apart from the specific tax regime for workers posted to Spain who have their tax residence in Spain, the Draft Law seeks to facilitate the entry and residence of highly qualified professionals, entrepreneurs and investors. The measures to be adopted in this area will be specified in forthcoming regulations. However, a special visa is introduced for the so-called “digital nomads”, valid for one year, for those foreigners who wish to reside and work in Spain remotely for a foreign company.

Corporate formalities and the role of the Administration

The Draft Law contemplates changes in the procedure for incorporating a start-up company. For example, they can start their activity from the moment they accredit their status as an emerging company and obtain the NIF, and formalize incorporation later on. The incorporation and termination of activity of emerging companies will be facilitated by enabling the process to be completely online.

Finally, the Draft Law proposes to encourage the collaboration of the public administration with emerging companies, not only through public aid, but also by reducing the guarantees that emerging companies must provide and promoting the creation of investment funds and collaboration between companies.

September 2021